As MPs increase pressure on providers to pass on higher interest rates, banks have been criticized for making "weak excuses" regarding customers' savings.

The Treasury Select Committee's chair, Harriett Baldwin, declared: "The time for lame justifications is over. ".

The financial regulator also stated that it would examine whether the minimal returns for devoted savers were providing fair value in the near future.

Banks claimed to offer a variety of deals at affordable prices.

Through a series of hearings and letters, MPs on the committee have urged banks and building societies to offer savers a better deal as interest rates have risen.

According to the financial information service Moneyfacts, a typical instant access savings account has an interest rate of 2.62 percent, while the average new two-year fixed rate mortgage has an interest rate of 6.78 percent.

Rates of interest have been increased by the Bank of England to 5%.

The issue, according to Ms Baldwin, is of "utmost importance" to the committee. "If the high street banks continue to pay poor savings rates on their instant access accounts, they should make sure their customers know that better rates are available," she said.

Lenders emphasized that accounts for consistent savers, or those that lock money in for a predetermined amount of time, provided significantly better returns than instant-access products.

The typical fixed savings rate for a year is 5.1 percent.

According to banks, customers were informed about these deals' higher rates.

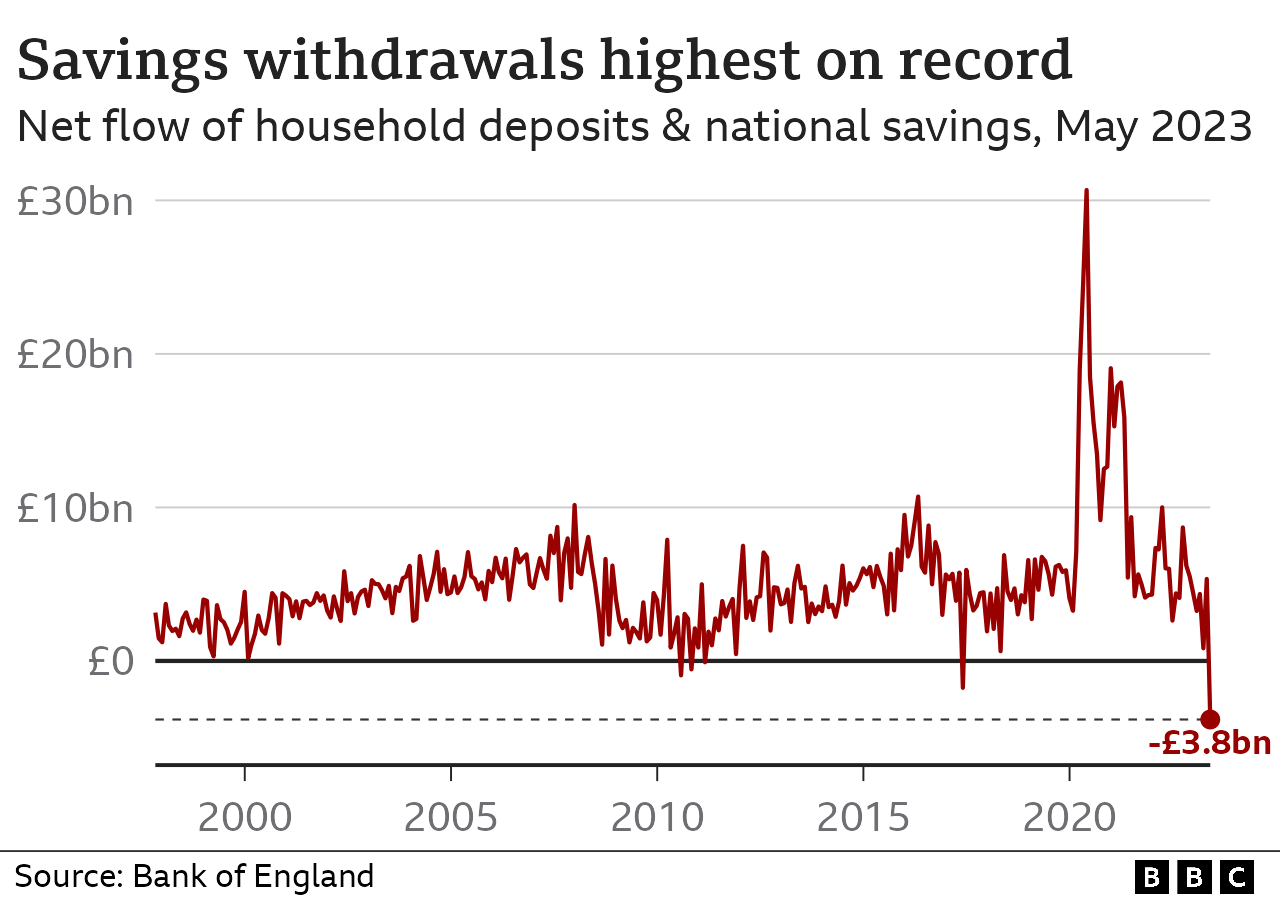

Billpayers dipped into their bank and savings accounts at a record level in May, according to prior Bank of England data. More money ($4.6 billion) was taken out of bank and building society accounts than was deposited.

The level reached there was the highest since comparable records first started 26 years ago.

The Treasury Select Committee has repeatedly expressed concern about whether savers are receiving the full impact of the rising Bank of England benchmark interest rate.

In a series of letters to the committee, bank executives highlight the difficulties in pricing while emphasizing that efforts have been made to encourage savers to compare all of the available options.

They also exhibit a few slightly different strategies. Barclays has reduced the number of products it offers, claiming that this makes it simpler for customers to understand.

According to its UK chief executive Matt Hammerstein, "Right now, we are intensely focused on ensuring that our simplified product range delivers the right value to our customers.".

The chief executive of HSBC, Ian Stuart, stated that his organization has "a broad suite of savings products to support different goals.".

A new Consumer Duty, according to Nikhil Rathi, chief executive of the Financial Conduct Authority (FCA), which oversees the industry, will make sure that customers are more aware of whether they can get a better deal from their current provider.

In a letter to the committee, he stated, "We will expect firms to have a strategy to ensure that their customers are adequately informed of available rates across their product set and how they may benefit from switching to an alternative.".

Those who keep money in the same savings account for many years receive some of the lowest rates.

When new regulations take effect at the end of the month, Mr. Rathi wrote in his letter that it would "be considering the question as to whether savings accounts for loyal customers which pay close to zero offer fair value.".

- You can look around for the best account as a saver.

- Because old savings accounts have some of the lowest interest rates, loyalty frequently doesn't pay off.

- Not just the big banks but a variety of providers offer savings products. The best deal will vary depending on your circumstances; it is not the same for everyone.

- Longer term investments offer higher interest rates, but not everyone's lifestyle will accommodate that.

- No matter how tight your budget is, charities advise trying to keep some savings in order to help cover any unforeseen expenses.

The independent, government-backed MoneyHelper website has a guide to various savings accounts and things to consider.