Despite interest rates reaching their highest point in 15 years, the number of mortgage applications has not yet decreased, according to Nationwide.

The building society did note that the activity in the housing market was likely to experience a "significant drag" as a result of the sharp increase in borrowing costs.

According to the most recent data from Nationwide, house prices fell 30.5 percent in the year to June, the most since 2009.

In an effort to curb inflation, the Bank of England raised interest rates.

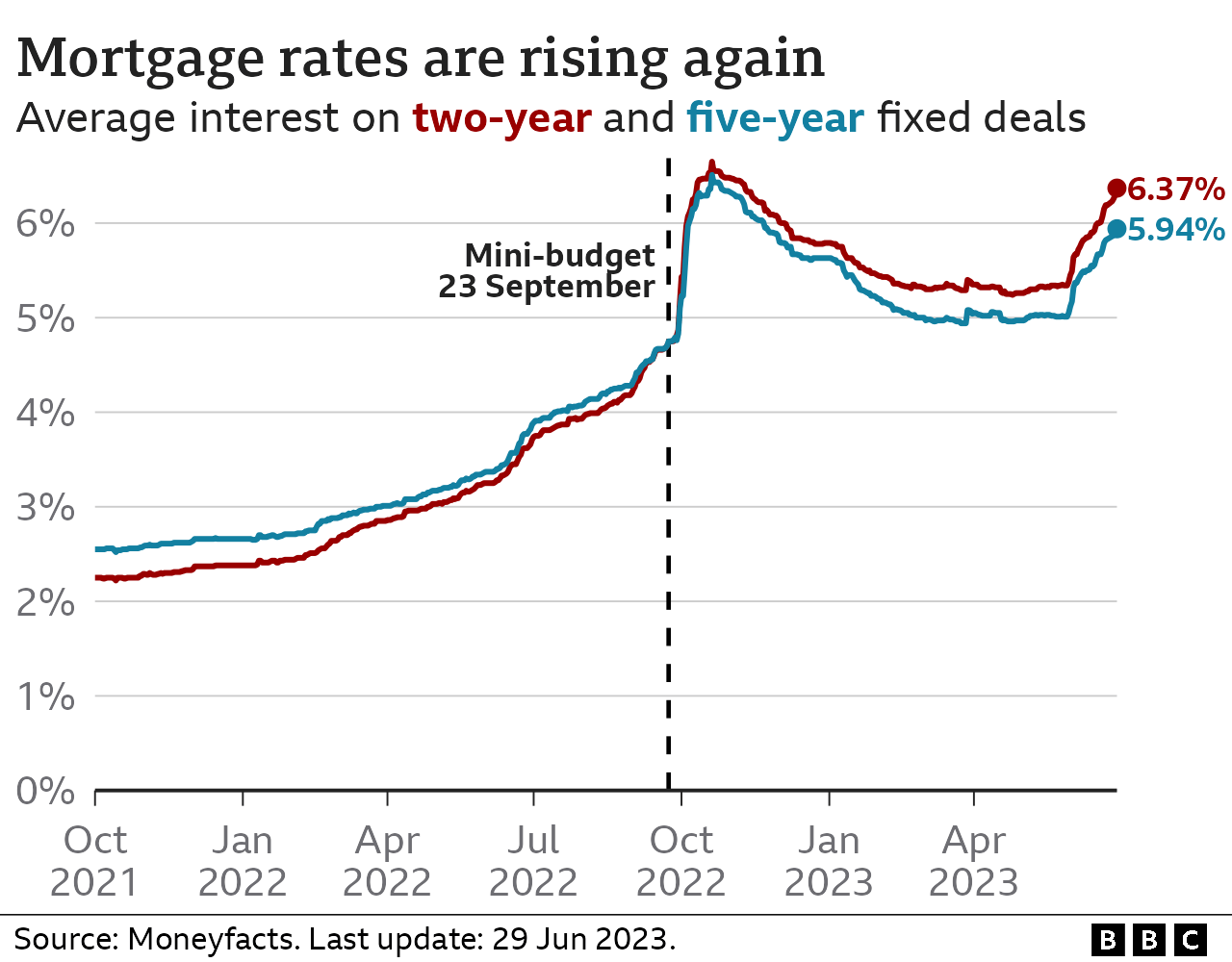

The Bank's base rate, which typically determines how much money lenders must borrow, is currently at 5%.

Mortgage payments now consume nearly 40% of people's average take-home pay, up from 30% previously, according to Nationwide's chief economist, Rob Gardner, on the BBC's Today program.

According to Mr. Gardner in Nationwide's most recent report, even though the cost of borrowing money for longer periods of time had increased, it had "yet to have the same negative impact on sentiment.".

"For instance, although they are still below long-term averages, the number of mortgage applications has not yet decreased, and consumer confidence indicators have improved over time. ".

Mortgage approvals increased from 49,000 in April to 50,500 in May, according to data from the Bank of England, despite higher interest rates for mortgage deals. The number of remortgage approvals increased from 32,500 to 33,600 during the same time period.

Due to the majority of homeowners being on fixed-rate contracts, the impact of higher interest rates on those who have mortgages is more gradual now than it was in the past. Only 15% of mortgage holders are on deals with variable rates, down from 70% 20 years ago.

The stock of outstanding mortgages, according to Mr. Gardner, is fixed in 85% of cases, but he cautioned that 400,000 fixed-rate borrowers would be refinancing every three months.

Mr. Gardner claimed that a typical monthly payment would increase by £385 when mortgage rates reached 6 percent for a two-year deal.

Despite the fact that this represents a sizable increase, the borrowers were stress tested at interest rates higher than those currently dominating the market to make sure they could handle the increase, he said.

If the labor market and interest rates function "generally as expected," according to Mr. Gardner, the UK "is unlikely to see the waves of forced selling that would probably be required to result in a more disorderly adjustment to the housing market.". .

Remortgagers, according to Sarah Coles, head of personal finance at Hargreaves Lansdown, "face potentially disastrous increases in their monthly payments.".

According to her, "the new rules will allow people to temporarily modify their mortgage in order to get them through the next six months, but there will be some who can't see any light at the end of the tunnel and sell up.".

There is, however, "still hope," according to Ms. Coles, that inflation will subside and mortgage rates will then decrease. .

Except for Northern Ireland, all regions, according to Nationwide, saw annual house price declines. While prices fell 4.3 percent in London over the previous year, they fell 4.1 percent in the North West.