The interest rate on a typical five-year fixed deal is now close to 6 percent as a result of a new round of rate increases by major mortgage lenders.

The Nationwide Building Society and The Halifax, both of which are a part of Lloyds Banking Group, the largest lender in the UK, have raised their rates for new loans.

They are one of many providers who have relocated recently.

Less than a week after the Bank of England increased its base rate, HSBC and TSB on Wednesday increased their rates.

On Thursday, a day after HSBC and TSB increased their rates by up to 0.55 percent and up to 0.35 percent, respectively, Nationwide increased fixed rates, available through brokers, by up to 0.35 percent.

The Bank of England shocked the markets by increasing its benchmark interest rate on Thursday of last week from 4.5 percent to 5 percent in an effort to combat the high rate of inflation.

Additionally, a number of lenders increased buy-to-let mortgage rates, which might result in higher rent for tenants.

According to Aaron Strutt of mortgage broker Trinity Financial, "[Changes] are definitely manifesting now.".

More large banks and building societies are raising their rates once more or discontinuing their mortgages, which means that new borrowers and those looking to refinance will have to make even larger repayments.

"Lenders continue to raise rates as they struggle to set the price for their mortgages, and this cycle seems to be going on forever. ".

He advised people looking for a mortgage to move quickly if they found a rate they liked and believed offered good value for money.

He claimed that some lenders were pulling rates because they were too busy, and other lenders were citing higher funding costs.

High Street banks are required to charge investors higher interest rates than the government because they are viewed as riskier investments. High Street banks raise money from the markets and then lend it to customers in the form of mortgages and other loans. These expenses are increasing and have now reached a level comparable to that following the mini-budget from the previous year.

The recent interest rate increases could result in hundreds of pounds more in monthly payments for more than a million people who are leaving fixed-rate mortgage agreements this year.

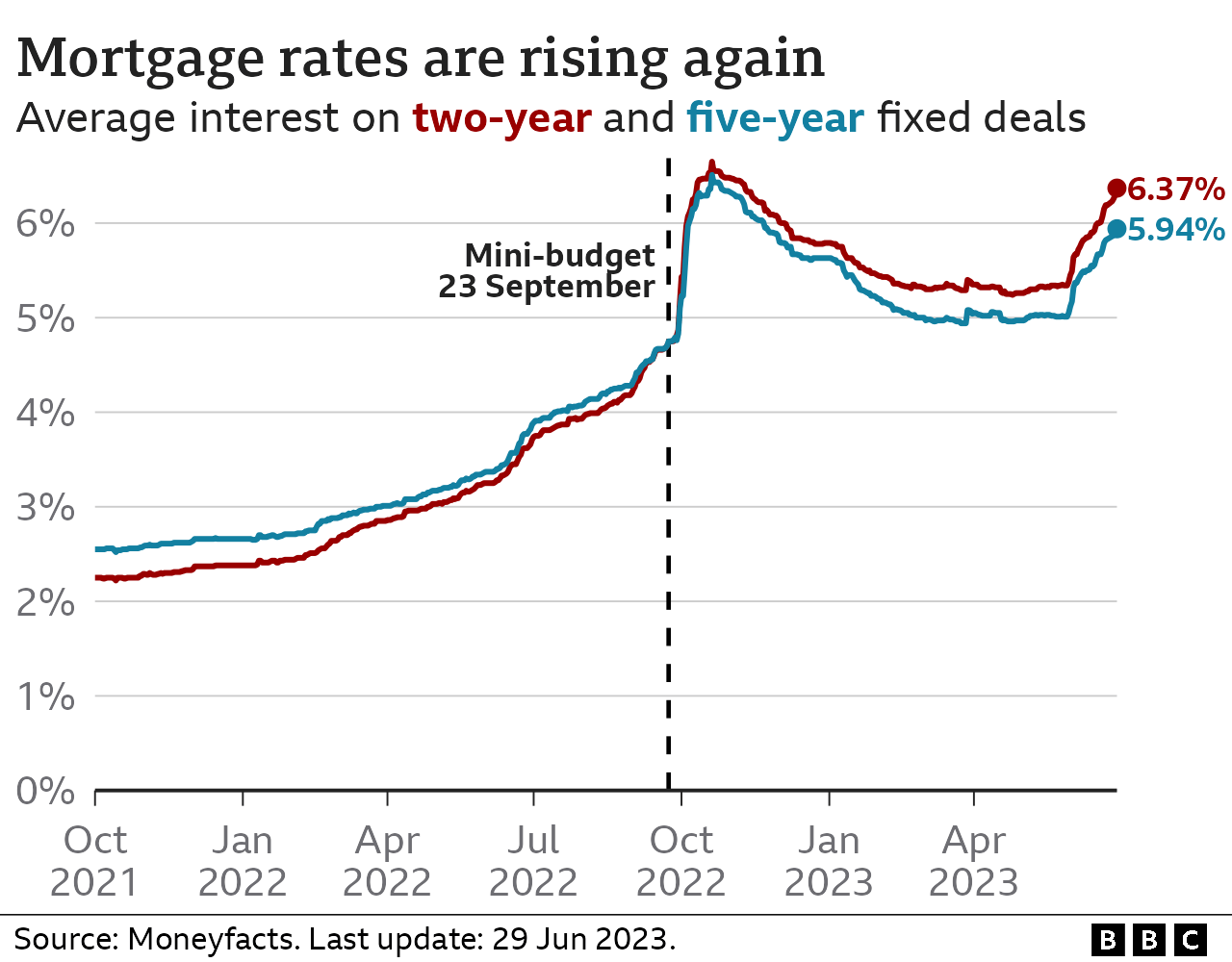

The most recent rate increases signify that average rates on new deals will keep rising, as they have been doing for months. According to financial data company Moneyfacts, the rate for a typical two-year fixed-rate mortgage is currently 6 point 37 percent, while the rate for a typical five-year mortgage is 5 point 94 percent. These rates were more in line with 3 percent in June of last year.

The average two-year and five-year rates were at their highest following the mini-budget, respectively, at 6.65 percent and 6.51 percent.

The opposition parties mocked Prime Minister Rishi Sunak's Sunday call for homeowners and borrowers to "hold their nerve" in the face of rising interest rates.

Following a meeting with mortgage lenders, some limited additional protection has been decided upon to help those who have difficulty making mortgage payments. They also provide some flexibility for those who want to temporarily modify their mortgage terms as well as a deadline to prevent quick forced repossessions.

Anyone who is having trouble should get in touch with their lender, who is required to provide assistance and explain any available options.

Before you find yourself in a debt trap, it is crucial that you do discuss your financial difficulties. Better off starting earlier.

Seek assistance right away if you believe you won't be able to pay your debts or if you are finding it difficult to manage them. There is assistance available, and you are not alone.

You can learn about your options from a qualified debt counselor.