If the government is forced to take over Thames Water, taxpayers will be responsible for its debts and operating expenses, according to the chair of the Business Committee.

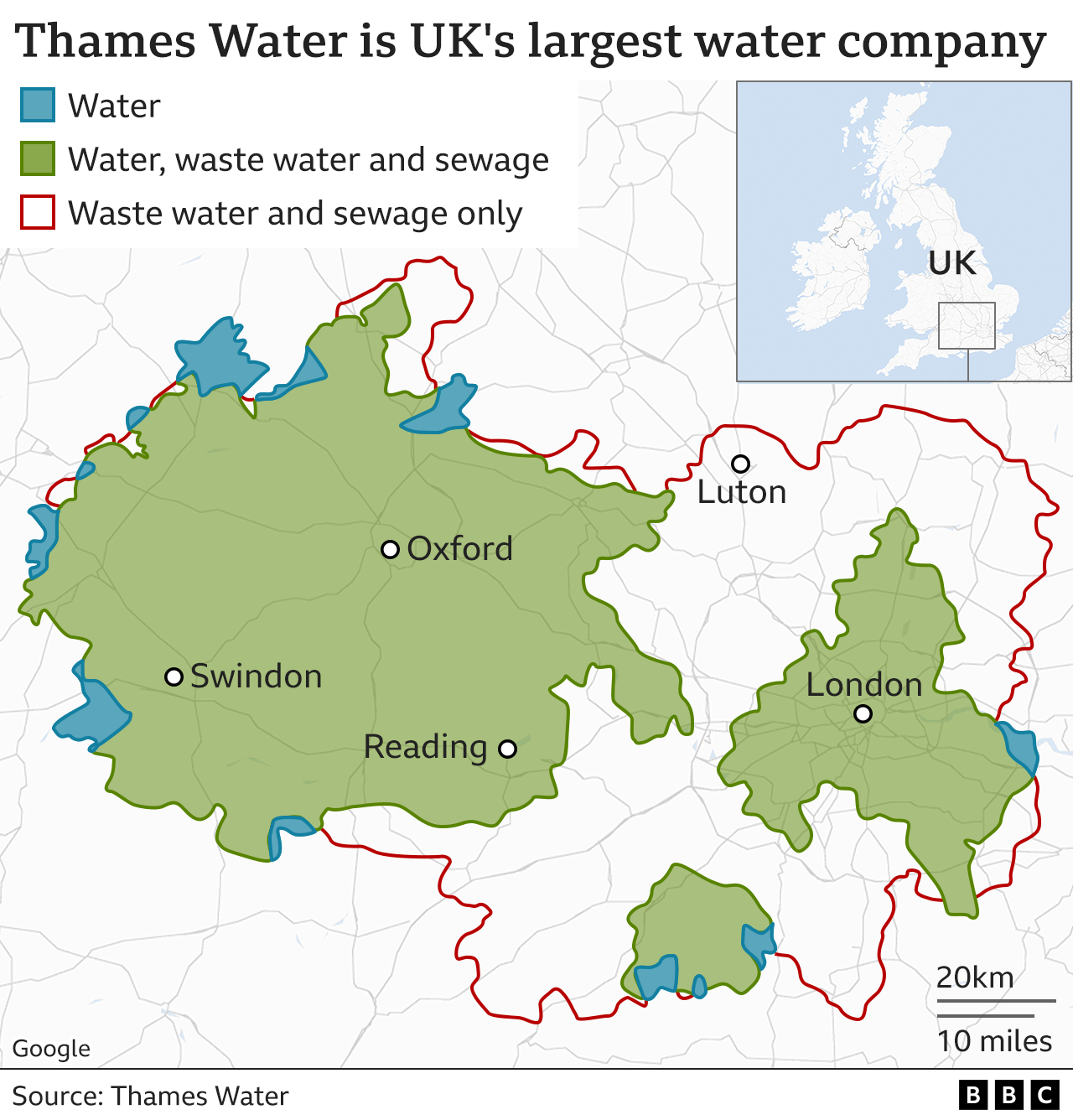

As it struggles to pay its debts, the largest water company in the UK, which provides services to a quarter of the country's citizens, is in negotiations to obtain additional funding.

In a worst-case scenario, if the company failed, the government declared on Wednesday that it was prepared to take action.

The availability of water won't change no matter what.

The chair of the Business and Trade Committee and Labour MP Darren Jones stated on BBC Breakfast that if the government was forced to take over the management of Thames Water, "taxpayers will be exposed to the debt and running costs of a very large company.".

According to him, the issues at energy companies over the past few years demonstrate that: "We have to bear the cost of running these failed businesses, which is why it's so upsetting for taxpayers to see that regulators and ministers have failed to spot this problem before it all blew up. ".

The government stated on Wednesday that Thames Water was the subject of "a lot of work going on behind the scenes" and that a process was in place "if necessary".

We need to ensure Thames Water as an entity survives, Business Secretary Kemi Badenoch said, adding that she was "very concerned" about the situation.

Following a string of sewage leaks and discharges, Thames Water has faced harsh criticism for its performance. The company leaks more water than any other water company in the UK, losing up to 250 Olympic-size swimming pools' worth of water each day through its pipes.

Thames Water has stated that it is working to raise the necessary funds, is updating the water regulator Ofwat on its progress, and still has "strong" cash and borrowing reserves available for use.

The company, however, is reportedly having trouble finding the funding it needs to pay off its sizable debt load, which is estimated to be worth £14 billion. Over half of its debt's interest payments are based on the rate of inflation, which has increased significantly over the past year.

In a special administration regime (SAR), the company may be temporarily taken over by the government if it is unable to secure additional funding while waiting for a buyer to be found. When energy provider Bulb encountered financial difficulties, this course of action was most recently taken.

After only two years in the position, Sarah Bentley, the chief executive of Thames Water, resigned on Tuesday. It happened after she was asked to forego her bonus due to the way the business handled sewage spills a few weeks earlier.